Some of the links in this post may contain affiliate links for your convenience. As an Amazon associate I earn from qualifying purchases.

Home is where the heart is, but for too many of us, it’s also where the debt is and where paychecks go to die. It’s also one area in which small savings steps can really add up and where everyday spending decisions can make a big difference. Here are some of my best and most surprising ways to cut household costs.

This post may contain affiliate links for your convenience. As an Amazon associate, I earn from qualifying purchases.

These tips that have helped my family get out of debt and stay out for the past 8 years. You can reduce spending on home expenses starting today. Ready? Let’s go!

…small savings steps can really add up and…everyday spending decisions can make a big difference.

How to Cut Household Expenses

- This first tip is really only surprising in that so few people actually do it. Yet it’s the first and best way to cut expenses. What is it? Track your expenses. Often we don’t realize how the little things add up. Bringing awareness comes first, then making a plan and being accountable to sticking to it can happen. It might hurt a little in the beginning to realize how much money is being frittered away on incidentals, but knowledge is power, and now you have the opportunity to choose differently. So track every purchase.

- Buy used furniture, but make sure it’s the best quality you can afford. You’ll have a much better chance of finding high quality furniture at resale and consignment stores. Once you get used to older, well-made furniture, you’ll be shocked by the low quality stuff found at new furniture stores, and the prices will leave you gasping for breath!

- Find out when the best discount days are at Goodwill and thrift stores and shop on those days. Ask about discounts for veterans and senior citizens, too. You’ll soon find your own set of favorite thrift stores — those with good prices and excellent quality, gently used clothing and other goods. I also recommend seeking out specialty thrift stores. When you’re in need of baby furniture and kids clothes, a kids-only resale shop will make your shopping easier since you won’t be wading through every other type of merchandise out there.

- Invest in a chest or stand-up freezer. Yes, it is an additional cost on the front end, however, it allows you to buy in bulk when items are on sale, which saves you in the long wrong. This works best for medium to large families. If there’s just the two of you, this may not make much sense.

- Before calling a repairman to fix an appliance or a car, look for YouTube videos and do it yourself. Repairclinic.com is a site that sells thousands of parts for such things as lawn mowers, power tools, appliances, and much more. Between the easy ability to get the necessary parts and training videos online, you can save yourself hundreds of dollars in repair bills every year.

- Your insurance agent won’t thank me for this, but each year, try to get better prices on all your insurance policies. In fact, mark “Insurance Review” on your calendar. Review coverage, deductibles, and ask about discounts you might qualify for. Compare companies, and don’t limit your shopping around to only the Big Names in the insurance business, such as State Farm and Allstate.

- Do the same thing with all your other bills: internet/phone packages, cell phone packages, electricity, etc. Be sure to compare not only prices, but features and benefits.

- Kids grow quickly, so organize a toy and kid clothing swaps with other moms. This is a true win-win scenario: moms get to socialize, kids get new stuff, and everyone is saving money!

- Depending on where you live, this might be tough, but if you can postpone using the air conditioning or heater for as long as possible, you could save a good amount of money in a very short time. Growing up in Phoenix, I know a few tricks about staying cool in hot weather and staying warm on a cold day requires layers of warm clothing and, perhaps, shutting off rooms that aren’t being used.

- Use a space heater and keep the central heat turned down to utilize heat in a way that continues to save money. There’s no need to warm up an entire house when you typically spend most of your daylight hours in just 2 or 3 rooms. Those are the rooms to keep warm.

- Consider extreme changes to your lifestyle, such as moving to a much cheaper neighborhood, city, or state. Other extreme steps: selling an expensive house and renting for a while, living with relatives for a while, or in an apartment with utilities included in the rent. Very often, these moves help a family rebound financially, save money, and prepare for moving on with their lives.

- Cancel subscriptions you don’t need or don’t use. Many of them are set to automatically renew, especially the ones that offered the free trial. Did you remember to cancel them?

- Try replacing name brand with generic items. Often–not always, but often–the generic brands are the same quality at considerable less cost.

- Use plastic grocery bags as liners for small size trash cans. These bags can also be placed over ripening fruit and vegetables to keep the birds away, used as a type of “glove” for picking up dog poop, or as packing material. They’re also handy as a daily compost collector. Just remember to empty the contents each day in your outdoor compost pile!

- Stay home more. Every time you go out there are temptations to spend money, but this doesn’t have to mean life becomes unbearably boring. Here’s a huge list of activities to choose from.

- Remove shopping apps from your phone. It doesn’t do any good to stay home if you can shop online and have it delivered to your doorstep. Removing the app is one more step removed from that temptation.

- Be a one-car family. It will take some getting used to and juggling of schedules sometimes but the savings in insurance, vehicle wear and tear, gas, repairs, etc. will add up. However, before you sell that extra vehicle, park it for a week or two to get an idea of what life will be like once it’s gone forever. How will its loss impact doctor and dentist appointments, school and sports activities, etc.? It’s better to find out now, while you still have that second car!

- Make your own coffee. I’m not talking about buying an expensive espresso setup, but I bet you’re clever enough to figure out a specialty beverage you could make at home. Remember when you tracked your expenses? (You did do that, right?) How much were you spending on fancy beverages? Now think of what else that money could go towards.

- Use the library. Honestly, the library is one of the best deals around these days. They are way more than just books these days. In additional to physical, ebooks, and audio books, our local library also has movie streaming, movies to check out, free passes to local attractions, free family events, and tons of free software available to use with a library card. It’s uh-mazing!

- Begin using cloth diapers, if you have a baby in the family. New styles are easy to use and most moms who make the switch from disposables say they’ll never go back. If you have an adult family member who may need incontinence pads, use baby diapers for their super-absorbency.

- Become familiar with what your dollar stores usually stock and when you need those items, go there rather than other retail stores where you’ll pay full price.

- Start drying your clothes on a clothesline and wash them cold water.

- Unplug electric items when not in use. One homeowner told me that he saved a few hundred dollars per year doing this.

- Weatherstrip doors and windows. For just the low cost of some new weatherstripping, you can keep your house cooler in the summer and warmer in the winter. If you’re not sure if a particular window or exterior door needs new weatherstripping, hold a lit candle near its edges. If you see the flame flicker, air is coming through the cracks around the door or window.

- Buy next year’s clothing at end of the year clearance sales. This is particularly helpful with higher priced items like winter coats and cold-weather boots.

- Gradually replace lightbulbs with LEDs. My electrician husband swears by LED bulbs.

- Run the dishwasher right after dinner and set a timer for when the washing cycle has ended and the drying begins. When the timer goes off, open the dishwasher door and let the dishes dry overnight.

- Go for long hairstyles and get a trim twice a year. Some stylists claim that a long hairstyle is more youthful!

- While your kids are young, learn how to cut their hair. If you mess up a bit, hey, they won’t even notice, and by the time they’re old enough to care, your skills will be advanced!

- Cut back or eliminate expensive activities for kids. Find cheaper or free alternatives – classes at Home Depot, REI, Cabela’s, Minecraft classes online, the library, and so much more. Remember what your own childhood was like, with far fewer extracurricular activities, lessons, and busy schedules? There’s a good chance that your imagination thrived and you turned out okay. So will your kids.

- Gas prices go up and down, but try to get in the habit of walking or riding a bike on nearby errands. Carpool when you can. Not only will this save on gas but also on the wear and tear of your vehicle. Add the health benefits of walking or bicycling, and it’s a winning combination.

- Stay away from stores that tempt you most. They have such an enormous variety of products that you’re bound to find something you absolutely need — or do you??

- If you need money in a hurry, go through one or two rooms of your house, garage, and/or attic, and look for items you no longer need, want, can’t wear, etc. Then sell them on a local Facebook page, Craigslist, etc. This is quicker than a garage sale, with no need to set up or price items.

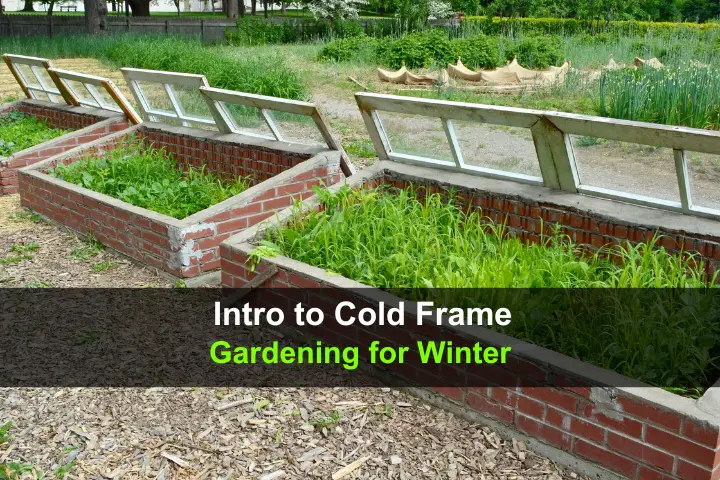

- Grow a garden. Even an herb garden is a huge, frugal help if you regularly buy fresh herbs for recipes. Watch your expenses, though, because store-bought mulch, fertilizer, seeds, supplies to build boxes, etc. add up quickly.

- Whether you grow your own garden or not, meal planning combined with learning to cook from scratch will save you money in the long run and save you from those pesky supply chain issues that are pretty normal anymore. It’s healthier, too.

- Begin your own compost pile out in the backyard. It’s a great way to enrich your soil, with no expense at all.

- Knit dish cloths from inexpensive cotton yarn (or yarn you spin yourself). You can make several from just one large ball of yarn. These make great gifts as well, and it’s a great way for kids to learn this useful skill.

- Don’t know how to knit? Learn this skill and hundreds of others on YouTube! Free training and, in many cases, even the supplies are extremely cheap.

- Ditch napkins and paper towels. Use small washcloths for napkins instead. You’ll be using these for years, versus continually buying the paper products.

- Make inexpensive homemade cleaning solutions from vinegar, baking soda, small amounts of liquid soap, and so on. For years, I used just vinegar and water to clean my stained concrete floors. You can’t beat that for being frugal!

- Cut up old t-shirts for cleaning cloths and save old, worn-out towels for really messy jobs, such as cleaning up after pet accidents or wiping up anything that might stain one of your nicer towels. I keep a large stack of these towels in a cabinet in my laundry room, handy for all the uh-ohs that occur on a regular basis.

- During cold weather, wear layers around the house, socks, and turn the heat down. I learned alot about using layers to stay warm during a trip to Iceland

- Collect blankets and use them to cover windows, doorways, and add triple and quadruple layers of warmth to beds! I always keep blankets handy in our living and family rooms.

- Never buy new vehicles. Ever. Let someone else drive that brand new car or truck out of the dealer’s showroom and enjoy the quick depreciation in value! You can lurk in the background, waiting for them to grow tired of their shiny new toy, either sell it or trade it in, and then you can leap into action, grabbing that vehicle at a huge discount.

- Maintain your vehicles with regular oil changes, keep the tires inflated, and take care of minor issues before they become budget-destroying expenses. This becomes especially important when you want to sell your used vehicle.

- Don’t postpone visits to the dentist and taking care of small cavities. Dental problems can become very expensive if ignored.

- Do your workouts at home, not a gym. Sooner or later, you’ll grow tired of the trips to the gym but will probably forget to cancel your membership. This will result in paying for something you aren’t using.

- If you have pets, find the best priced pet insurance. It may make the difference between saying goodbye too soon to a beloved pet and being able to afford expensive medical treatment.

- Ask doctors for samples of pharmaceutical medicines. Many are willing to do this — no problem at all. Not only will it help you to know if you’ll have any negative reactions to the medication before buying it, you’ll also save money. Years ago when we didn’t have health insurance, my husband’s doctor gave him a supply of one prescription for over a year.

- Do your own yard work and housecleaning, or pay the kids to do it. Be sure to thoroughly teach them how you want the job to be done. This is vital to developing their work ethic, attention to detail, and ability to follow directions. If you don’t believe in paying kids to do household chores (above and beyond their typical duties), then don’t!

You can save money on household expenses starting today. Click To Tweet

Here are even more resources to help you save money!

What are your favorite ways to save money on household expenses?

Originally published April 19, 2016