Susanne Posel, Contributor Activist Post In 2011, the technocrats devised a scheme, with the assistance of Hans Hoogervorst, appointed chairman of the International Accounting Standards Board, that Europe would be included in IFRS9, a new rule that eliminates mark-to-market accounting of sovereign debt from the European Central Bank’s balance sheets. When mark-to-market practices were installed in 2009, it led to a short-term market recovery, which presented a false positive as banking institutions no longer had to provide capital to promote long-term financial stability. In the Euro-Zone, banks can now conduct business as sovereign debt becomes the only path that can be taken by countries being affected by the technocratic takeover. Under the guise of creating jobs, Ben …

Susanne Posel, Contributor Activist Post In 2011, the technocrats devised a scheme, with the assistance of Hans Hoogervorst, appointed chairman of the International Accounting Standards Board, that Europe would be included in IFRS9, a new rule that eliminates mark-to-market accounting of sovereign debt from the European Central Bank’s balance sheets. When mark-to-market practices were installed in 2009, it led to a short-term market recovery, which presented a false positive as banking institutions no longer had to provide capital to promote long-term financial stability. In the Euro-Zone, banks can now conduct business as sovereign debt becomes the only path that can be taken by countries being affected by the technocratic takeover. Under the guise of creating jobs, Ben …

Article by Activist Post. Read entire story here.

Thursday, November 21 2024

Emergency preparedness news and information for survivalists and preppers

Latest

You May Also Like:

Categories

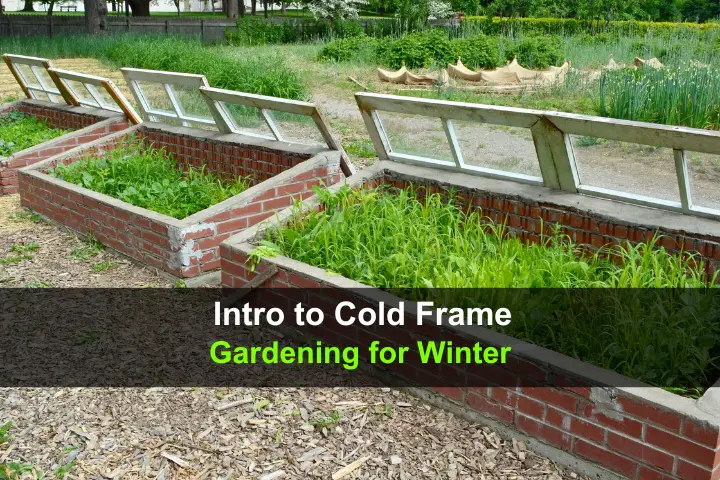

Intro to Cold Frame Gardening for Winter

Categories

Nerf Elite HYPERFIRE Blaster | Nerf Gun Review & Unboxing in 4K!

Categories

CAMOUFLAGE ZIPPO LIGHTER GIFT SET Review | Titan Survival Product Review Combustion Category

Categories

Fatrope Fire Starter Keep This in your Survival Kit!

Categories

5 Best Bushcraft Knives You Need to Carry – Part 2

Categories