Yilmaz Akyuz As the crisis in advanced economies (AEs) has laid bare the deficiencies of unfettered financial markets and developing countries (DCs) have started exploring ways and means of counteracting destabilizing capital inflows triggered by quantitative easing and historically low interest rates in major AEs through various measures, the IMF has been compelled to reconsider its position on capital account liberalization. After two years of pondering it has now come up with an Institutional View, discussed in its Executive Board and endorsed by most Directors. It is meant to guide Fund advice to members and Fund assessments in the context of surveillance, while it is also reiterated that…

Article by TripleCrisis. Read entire story here.

Thursday, November 21 2024

Emergency preparedness news and information for survivalists and preppers

Latest

You May Also Like:

Categories

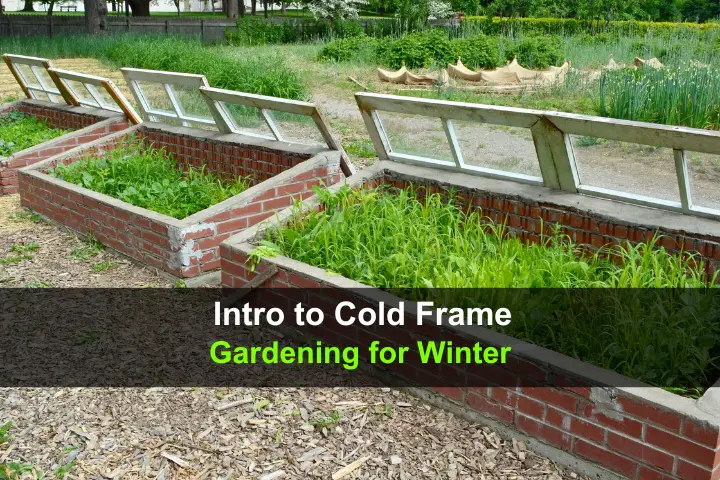

Intro to Cold Frame Gardening for Winter

Categories

Nerf Elite HYPERFIRE Blaster | Nerf Gun Review & Unboxing in 4K!

Categories

CAMOUFLAGE ZIPPO LIGHTER GIFT SET Review | Titan Survival Product Review Combustion Category

Categories

Fatrope Fire Starter Keep This in your Survival Kit!

Categories

5 Best Bushcraft Knives You Need to Carry – Part 2

Categories