ho was it, just the other day, told me they’d finished Jared Diamond’s book Guns, Germs, and Steel: The Fates of Human Societies (20th Anniversary Edition). They remarked it seemed a bit wordy. “He said things that could have been 10-words or less, in a hundred…”

Since I’m still carving out time to finish editing The 100-Year Toaster – which deals with the replacement of quality metrics by financial measurements – I am uncomfortably familiar with the writer/editor’s plight.

Pardon the mention, except to say GGS is still a good read. How many words to use is a problem faced daily around here. Which I will try to keep in mind as we roll through today’s JWW synopsis.

Jobs First

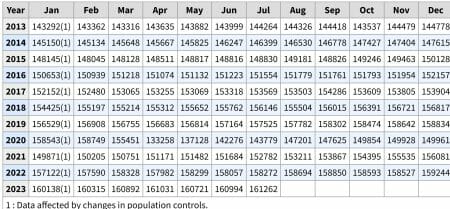

Though it’s anti-climactic. Because the Jolts report from Labor was reasonable. As was the ADP report Wednesday, and the Challenger job cuts yesterday. No reason to expect any Big Surprised in the EmpSit report just out:

Total nonfarm payroll employment rose by 187,000 in July, and the unemployment rate changed little at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, social assistance, financial activities, and wholesale trade.

Still, we’re somewhat confident that while things might rally early, the Official data run from Labor looks like this for the last year.

We could mention other aspects, such as the number of jobs “estimated” into existence for the month. 280,000, so virtually all of the claimed gains in today’s report. But some fraction of those estimates are real.

But beyond that, if you’re working, you may not care. And if you’re not working, you’re probably not looking very hard. It’s become something of an employee’s marketplace.

Where We Are in Summer

I mentioned a few days back that with all the hot weather we’ve been seeing, we might want to watch for an upside surprise in the number of sunspots. I’ll be damned, the Spidey sense hits again:

Might it be that the recent pop is what finally broke our nice cool early summer this year? My buddy the Major reminded us in a convo Wednesday about the almost endless string of hot weather in 2011. Spike in the cycle about then, as well. Similarities seem to abound.

Notwithstanding, the Amazon Summer Ending Indicator has fired with the arrival of the Back-to-School tab on their pages.

If I was retired with nothing to do, I’d be studying which company’s earnings are most aligned with (and opposite) of the solar numbers.

What’s Also UP is Markets

Our market dart Thursday suggested a turnaround. Sure enough, we bounced at the upper green Wave II upper bound:

It’s important to remember we are still “in the zone” where a marginal higher-high would fit. As we described in Tuesday’s column. Our Monday call of a “week on rails” feels about right in retrospect. Can stories like Warren Buffet’s not worried about Fitch’s U.S. downgrade. Should you be? (consumeraffairs.com) paper-over the Fitch downgrade?

Phase Noise and Jitter

Keeping us “charged” in the electronics sense, while trying to keep a great S/SNR, the “Jitters” part may relate to Ukraine. Where the news of an easy UKR victory is quite oversold. Debacle of Ukrainians in Bakhmut: Hundreds of Ukrainian soldiers sacrificed in Berkhovka – Anger in the US with Zelensky’s regressions!”

But Ukraine is still kicking Russia as escalations continue “Russia accuses Ukraine of attacking Black Sea navy base and Crimea with drones.

Here in the hockey stick curve change of this war, seeing Russian ship hit in Novorossiysk, Black Sea drone attack, Ukraine sources say, makes us think about shorting over the weekend. Because we’re in event sequences that seem to hold little likelihood of positive upside events. I’ve made more money on getting declines right than upside rallies.

Our view is we might see as early as this weekend, Ukraine/neocons escalating to more Moscow strikes, in order to force the Russians into first use of nukes. But the libretto seems plain, enough.

Also useful to know in the military sphere: 2 U.S. Navy sailors arrested and accused of spying for China, which is not surprising. And not going anywhere is Niger President Bazoum calls for U.S. help in coup. America’s problem is we are out of resource and pretexts to light off a boots-on-ground offensive in a new region. The Bought ‘It administration has negligently allowed us to be flanked by our resource aware competitors on the world stage. We’re losing – badly. Like chess, tik-tock.

The Out of Phase Parts

Back in the Den of Dweebs, here’s how this will role. Appeals Court Allows Controversial Biden Asylum Policy to Remain in Place.

When woke invasion tolerance is challenged in the Courts, the liberals on the Appeals Courts will support the Open Border Nonsense. If appealed to the more balanced Supreme Court, reversals cluster.

There is a reason some 1970’s major market radio news directors (at least 3 of us, anyway) agreed we’d refer to call it the “9th Circus Court“. If you have problems with normal thinking, seems like they gotcher back.

And speaking of government and the Courts: Testimony from Hunter Biden associate provides new insight into their business dealings | AP News. Oh, no Courts. Well, whoddah thought, huh?

ATR: Air Conditioner Follow-up

You might remember a while back I told you about the install and use of a nearly silent new air conditioner in my office. But here’s some feedback you may find interesting:

I did some reading on the question. Found a reasonable (both sides of this) presentation in R410A vs. R32 | Differences, phase-out, retrofit 2022 – Ex-Machinery B.V. but read and make your own call.

Further point to Mark’s voicemail is that changing our view of things to more than “two measurements deep” to broader inquiries. My decision was driven mainly by noise and reliability.

Got something to tell the world? Leave us a voicemail on (903) 740-0596!

Funny Money?

Will the halving result in a doubling? Bitcoin miners need BTC price over $98K by the halving — Analysis (cointelegraph.com).

We have absolutely no sense of this, except that BTC is still down in the $29,100 range at press time.

On the other hand, a pal of George’s drop by last night. He’s got a (PPA filed) patent for Instant Final Settlement which could actually make crypto make sense. Because the system doesn’t require conventional server transits, and it also sets up a replacement technology to conventional DNS.

For now, he’s looking for an Angel while taking occasional breaks from weeklong code grinds to get the demo built. A few skydives from now, back to grinding. (Dude jumps a 60, by the way, saying “If you don’t get as much from the landing as the jump, what’s the point, right?) Prolly 10k jumps, dude is serious.

Interesting people around here, now and then.

Be sure to drop by over the weekend. Second half of our gentle introduction to electronics troubleshooting should be along in ShopTalk Sunday. First part was last Sunday. Electronics is the favored hobby in the scalding hot summers in eTex.

Write when you get rich,

G