Here’s a shocker for you: The day after Memorial Day this year, the total U.S. Public Debt to the Penny was $31,463,988,658,765.75. Too many numbers for this early in the day? Then call it $31.46 trillion.

As of the most recent numbers posted, the Public Debt to the Penny is up to $32,661,578,249,677.03. But again, too many little numbers. We’ll round it off to $32.66 trillion.

Simplifying: The public debt to the penny is up $1.2 trillion in just 82 days.

Go with me on this, because I’m expanding on the notion breached in Thursday’s column here. Namely that the Fed is likely passing the point of no return, lighting off high rates of inflation for the foreseeable future. Because – if we assume there are at least four such periods in a year (there are actually 4.48) we can do some simple compounding. Let’s see how bad it could get, shall we?

Public Debt is up 3.8143 percent in 82-days. If we compound that out four times (a year’s worth)? A rational lookahead says the National debt will compound north of 16 percent in the coming year.

Has the Fed already lost it? They had two extremes – either of which would have moved public thinking on spending. But “namby-pamby” is not “leadership.” And trend following results in financial hazard, near as we figure.

To the point? I warned again yesterday that the Fed needs to get real tough – instantly – or permanent inflation will return. Bonds are rising (along with mortgage rates) and the Fed misses that the 2021 collapse of stocks came at the bottom of long-term rates. Not at the (comparatively) higher rates in 1929.

With rates going up, Big Money is likely to move out of stocks. And back into Bonds. The Fed will simply now track the return of inflation.

A Deflationist Speaks

I’ve mentioned my colleague Jas Jain, a number of times. I was delighted to get an email from him this week, confirming our worst fears:

“A few weeks ago, George Ure, whom I got to know at Longwave Forum some 25 years ago and later met him and his wife when they were visiting SoCal, asked me about the long-term bonds (since I have a pretty good record) and how the bonds would impact the stocks. He runs his own website regarding the replay of 1929 in stocks. We both subscribe to long-term cycles in the economy that lead to cycles in stocks and bonds.

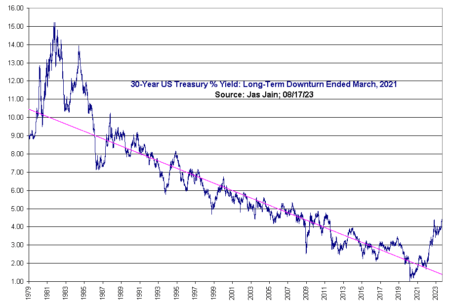

30-Year Treasury yield peaked in September 1981, i.e., bond prices bottomed and the Long-Term bull market in bond prices began. Eleven months later, the Long-Term bull market in stocks began that most likely ended at the end of 2021.

In the attached graph one can see that there has been lot of volatility in the yield, but the trend line is clear where the yield was falling for some 40 years until March 2021 when it broke the trend line on the upside and there is no end in sight.

“The Bond Market Smelled the RAT in March 2021

Everyone knows about the gigantic COVID stimulus under Trump in 2020, far bigger than any other country. With Democrats in power, it became very clear that a lot more stimulus is going to be in the pipeline with no end in sight, i.e., there is going to be huge demand-driven inflation from all the govt money in people’s accounts waiting to be spent after COVID. The long bond smelled the inflation rat 3 months before the annual inflation rate hit 5% and 12 months before the Fed acknowledged the problem and started to take the baby steps to tackle the problem. This fight has a long way to go, as was the case in the late 1970s and early 1980s. It would require a serious recession like 1981-82 to force people to spend less to curtail the demand. There is no doubt about that.

If the Long-Term bull market in stocks lasted for some 40 years, with lots of up and down short-term cycles, one can guess how long the down cycle would last, also with many ups and downs along the path.”

Jas, with a PhD. in digital signal processing and now retired from “the big router giant” is pure gold when it comes to “signal to noise” in long data sets. And economics is less about theory and more about derivation of behaviors in long, noisy data sets.

Where Does It Lead?

Let’s go through this stepwise.

- First: The Fed, as noted, is not a “leader” in any sense. They are “trend followers.” We could debate this all day, whether government (and its profligate proxies) should lead or simply follow the secular financial markets. The data says “leadership” is pretend and “trend-following” is more real. As a succession of Fed Chiefs has demonstrated while claiming “leadership” the numbers argue the opposite.

- Second: We can simply “count the years” from 1981: 42-years so far. So, the Fed still has a chance to raise rates enough to generate one more collapse of rates (to below the effective lower bound), which would lead to a nearly idealized Kondratieff/Kondratiev cycle ending around 2031. However, in order for this to occur, public consumption would need to be curtailed (reducing the balance of trade deficit) while at the same time, presenting a large enough existential threat that the public would accept the yoke of higher taxes.

- Third: Accounting realities matter. The simply projected higher debt we just penciled out (the 16 percent debt increase) coming in the next year will be divided among about 161.262 million workers.

A statistical disclaimer: There is some circularity in these numbers because a great deal of employment (such as education and defense) are government spending dependent. But we can readily see what your portion of Bidenomics will cost in the coming year: 16 percent of 32.6 trillion, divided up by 161.262 million workers under tax slavery. Comes out to $5.2 trillion spread out over call it 162 million workers, so about $32,098 per American worker. (Don’t blame me, I didn’t vote for these jokers!)

- Fourth: Economics can be heard already screaming “Change of Senate and President in 2024” because the odds line today favors a change-out of the Free Lunchers. BUT, it is far from certain. For one, the nation is on the cusp of multi-axial insurrection. Haters right and left, old and young, racial group vs. racial group, and rich-poor – everyone’s got an axe to grind – and an opponent to bury it in when sufficiently sharp, or when opportunity presents.

We can squint, in a particular way, and see things even WORSE in a year. Because we not only have the commercial real estate meltdown coming, but that round of Covid has left people unwilling (in many cases) to return to the daily freeway grind and the office politics bullshit that goes with ranching a cube farm.

This may explain the desperation of the Neocons (who are the same embeds that Trump inherited at State) who are attempting for all they are worth to light up “nuclear war lite” in Europe.

See, it’s all going to come down to yoking up the tax plebes. And to do that, government needs a horrible threat (nukes works) because the accounting is going off the rails. Oh, and let’s not forget Social Security will be running out of dough, sooner than later, too, so whichever party is left holding this “steaming bag of shit” post 2024 could have a storm of radiation, a part 2 of pandemics (maybe racially targeted), the loss of Taiwan, attacks on American fine-pitch semiconductors, and the concurrent blow-up of America’s losing Dollar Hegemony while explaining to people who worked their whole lifetimes, why the “good times” Medicare and Social Security have paid for are ending. In flying, this would be an unrecoverable secondary stall.

Meantime, Agent Orange may be sitting in a cell. Hunter’s going to walk, but the impeachment articles against Biden are on a roll, too.

Here in the Outback of East Texas today, I’m picking up a hydraulic hose for the Kubota tractor. In other words, “life goes on” (with a 5-gallon jug of hydraulic fluid).

That seems to be the direction for now (only a long-shot the Fed will get down to negative rates, but it would be grand from a K-Wave fulfillment standpoint). War first this time, instead of after-Crash in the 1940s last time? Whatever, historical rhymes work out, I guess.

The capper in this discussion? No splurging: Inflation fears are keeping Americans from making impulsive purchases in 2023 – Study Finds. Retail sales up only one percent screams this fan is on and the dark gooey smelly stuff approaches…

Whew! Chill. Let’s move on to the apparent arrival of Wave III down in stocks which has its own “special scent.”

Wave 3 – It’s Getting Ugly

What was I telling you about long-wave economic projections? Markets will oftentimes “make their waves” and we seem to be doing that, once again.

Wave 3 down (at the big, ugly yellow scale) seems to be “on the verge” and on tap for this fall:

The next Fed FOMC meeting pops September 19-20. Our thinking is that a month from now the Fed will be forced by markets to raise rates another quarter. Which will continue the strengthening of bonds and the falling apartness of stocks into year’s end. Long-term bottom in early 2024? Joe Biden to save us?

Nope – it will be late next spring only the Wave 4 rally – if we’re not all smoked by nukes beforehand. Secondary stall, anyone?

But at least, unlike Covid, radiation levels will make great public health pretexts with direct government control instead of power and profit sharing with Big Pharma for what follows… Gads!

Details of the Bummers

Headlines like these are the “snowfield markers of Future” to us.

A discussion of the 84-year (Uranus) cycle on Peoplenomics tomorrow. But for now, we just note that it has been 84-years since “Boss Angeles” (with a nod to KHJ in the olde days of radio) has been smacked by a hurricane. Hilary rapidly grows to Category 4 hurricane off Mexico and could bring heavy rain to US Southwest. At least someone will get rain…

Dust Bowl Started in 1930 – so yes, this week we have:

Why ask if you already know the answer to a question? Trump lawyers seek 2026 trial date in federal election case. The answer’s going to be “No!” so why ask? He’s been cast as “agent orange” and will not get the deal (wink-wink) like the president’s kid… Nope, going to be more like Justice Department seeks 33 years in prison for ex-Proud Boys leader Enrique Tarrio in Jan. 6 case.

Going to Camp David, anyone? Hunter Biden stays close to father at White House amid criminal probe.

But, like we were saying, a lot of distractions because the U.S. is angling for war to reassert “leadership.” (Code for: war.) U.S. approves F-16 jets transfer to Ukraine from Denmark and Netherlands. Which the Russians counter via their proxy next to Poland with Belarus would use nuclear weapons in the event of ‘aggression,’ Lukashenko says.

Anyone besides me (and the wild land fire carded son) notice how much suspended particulate has been coming from Canada this year? More coming as Yellowknife, Northwest Territories: Thousands scramble to evacuate capital of Canadian territory as more than 200 ‘unprecedented’ wildfires blanket region.

Speaking of “smoking”: iPhone 15 rumored to support up to 35W fast charging speeds (pocketnow.com). Let me know when I can just put an iPhone on my stick welder for a minute…

Absurdium Redux: Microsoft AI listed Ottawa Food Bank in travel guide, suggested “going empty stomach” – Neowin. It’s OK, big brains with no couth has been a problem for humans, too. A surprising number get rich off lack of couth…

Recalls: Over 1,500,000 dehumidifiers recalled due to fire risk — check if yours is affected | Tom’s Guide (tomsguide.com). So much for drying out ahead of the weekend, huh?

Different kind of recall in the East Bay: Recall effort aimed at unseating Alameda County District Attorney Pamela Price moves closer to gathering signatures. Wait…could the people take back San Francisco from anarchists? Can Portland? Seattle??? Stay tuned – this would be a dynamite live/reality TV deal if anyone had the balls to shoot and produce it… Naw, State TV would not run it. Too critical, too real…

Around the Ranch

Hotter than Phoenix? Here? By 3-degrees today!

Yep. And worse, the rain in the forecast for next week evaporated from the forecasts overnight.

We can’t really bitch too much about it, though. We are still almost 3-inches ahead of last year on YTD rainfall and the mean temps haven’t been too bad.

It’s the kind of weather working outside isn’t so bad – as long as everything’s done by 8:30 AM…

Write when you get rich,

George@Ure.net