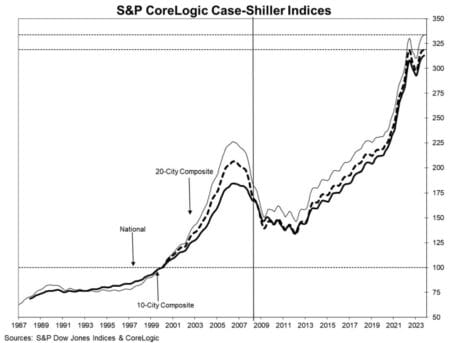

More evidence the Fed was right on HFL – higher for longer:

“YEAR-OVER-YEAR

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.8% annual change in October, up from a 4% change in the previous month. The 10-City Composite showed an increase of 5.7%, up from a 4.8% increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.9%, up from a 3.9% increase in the previous month.

Detroit reported the highest year-over-year gain among the 20 cities with an 8.1% increase in October, followed again by San Diego with a 7.2% increase. Portland fell 0.6% and remained the only city reporting lower prices in October versus a year ago.

On a closer-in view of things:

“MONTH-OVER-MONTH

Before seasonal adjustment, the U.S. National Index and10-City Composite, posted 0.2% month-over-month increases in October, while the 20-City composite posted 0.1% increase. After seasonal adjustment, the U.S. National Index, the 10-City and 20-City Composites each posted month-over-month increases of 0.6%.

ANALYSIS

“U.S. home prices accelerated at their fastest annual rate of the year in October”, says Brian D. Luke, Head of Commodities, Real & Digital assets at S&P DJI. Our National Composite rose by 0.2% in October, marking nine consecutive monthly gains and the strongest national growth rate since 2022.” “Detroit kept pace as the fastest growing market for the second month in a row, registering an 8.1% annual gain. San Diego maintained the second spot with 7.2% annual gains, following by New York with a 7.1% gain.”

Now, let a load of the actual prices and tell us our discussions of hyperinflation to keep this POS economy afloat were wrong:

So, at the absolute tippy-top of the Housing Bubble you could buy a house for what? $185k, call it? Which today would be (squints to see it) about $311k?

Which means is just over a decade a 68% gain on prices of the same general asset in the wake of a “Never gonna let something like this (housing bubble) happen again!” event.

Think government or corrupt money interests loading debt into our once convertible currency are to be trusted?

Nope. Road to nukes to blow up the evidence, but there’s the foreplay, up close, personal, and in Ure face.

No growth economy (save for the open border growth which is about it).

Meanwhile, slap the 96-hour timer to see if Russian reprisals are a bitch as Huge blow for Putin and Russia as Ukraine destroys another warship in Black Sea. Bet me?

Write when….honesty appears in Finance?

George@Ure.net