I love stories like this: As a solo general surgeon in private practice, in 2004, with a gross business income before taxes of roughly $500K, I figured that the 39.6{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} Federal + 9.98{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} Iowa state top income tax rates + 6{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} state sales + Medicare which no longer peaked out, + property taxes, medical license fees, malpractice fees which were already at $100K for me and headed higher, and no scholarship help for the 4 out of 10 kids in college at the time, my marginal rate was somewhere north of 70{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198}. Once I ‘retired’ from surgery and became a biology professor, making around $50K, my gross income was one tenth as much, but now one of…

I love stories like this: As a solo general surgeon in private practice, in 2004, with a gross business income before taxes of roughly $500K, I figured that the 39.6{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} Federal + 9.98{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} Iowa state top income tax rates + 6{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198} state sales + Medicare which no longer peaked out, + property taxes, medical license fees, malpractice fees which were already at $100K for me and headed higher, and no scholarship help for the 4 out of 10 kids in college at the time, my marginal rate was somewhere north of 70{0e3fbd49920d66d312335c9ab31e3d7b441ff7521e58af8d4d0648ba5d548198}. Once I ‘retired’ from surgery and became a biology professor, making around $50K, my gross income was one tenth as much, but now one of…

Article by The Humble Libertarian. Read entire story here.

Thursday, November 21 2024

Emergency preparedness news and information for survivalists and preppers

Latest

You May Also Like:

Categories

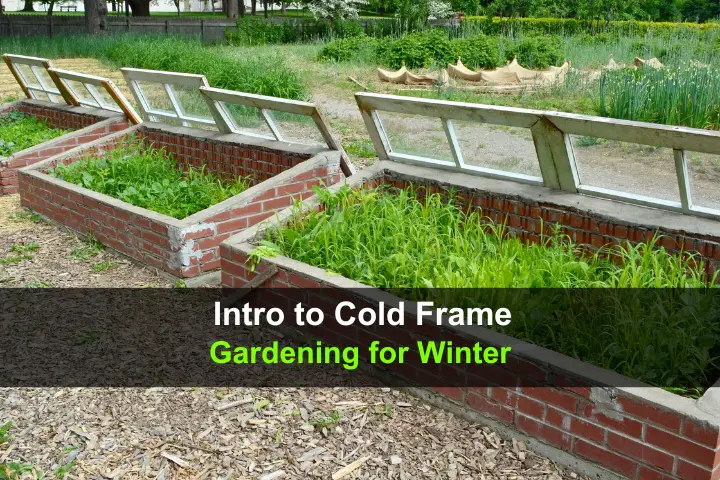

Intro to Cold Frame Gardening for Winter

Categories

Nerf Elite HYPERFIRE Blaster | Nerf Gun Review & Unboxing in 4K!

Categories

CAMOUFLAGE ZIPPO LIGHTER GIFT SET Review | Titan Survival Product Review Combustion Category

Categories

Fatrope Fire Starter Keep This in your Survival Kit!

Categories

5 Best Bushcraft Knives You Need to Carry – Part 2

Categories