Our Monday diatribe begins by noticing that the Market is not sure what to make of this “Momentary Peace Talk” going around. Because, when comes down to it, it’s like we told you some weeks back: “Ceasefires tend to happen when both sides run low on ammunition.”

An example of this shapes up in Ukraine. Where the coverage leans toward “we lost” but wrapped in more words. The “bomb” went off – V. Zelensky: “We will retreat – We have a serious shortage of 155mm missiles due to Israel” – End of indefinite free aid from the US. Always a scapegoat, my friend. Always.

However, the real perpetrators of this, or should we say perp-traitors, are the runaway neocons in the Buyed ‘Em administration. They took root in the War Party administration when they couldn’t goad Trump into starting a war on his watch.

Now, the neocon blowback is showing not only along the 1,500 mile “extended front of WW3” but further north extension looks possible. As Moscow front with Estonia and Finland: Border posts closed and deployment Army – Hundreds of foreigners besiege NATO border.

On the road: Defense Secretary Austin Makes Unannounced Ukraine Visit, Assures Kyiv of Continued Support Against Russia.

A man with a gun is only reasonable until the other guy gets one. Then, the rule of online gaming comes to roost: “first look, first shoot.

Peace Break?

We really don’t know, yet. Lots of talk & hype about that over the weekend – pause for hostage exchange. But now we’re reading about another hospital being involved: Heavy Fighting Breaks Out Around Another Gaza Hospital even as reports come in about (2) Al-Shifa hospital’s newborn babies heading to Egypt by ambulance.

Markets Distrust Peace

There are plenty of reasons for this, of course. For one, the Death Stocks – armorers to the world – can’t sell enough product to maintain elevated profits. Bad for business.

Thus, wildly overpriced, in our view, stocks aren’t sure where to go from here.

On the one hand, more debt-based (made up) spending makes the strong case for inflation. On the other side, though, war destroys financial assets (killing people and breaking things) which, it might be argued, is disinflationary. Readers have been asking me which way it will go from here and the simple answer is “We’re waiting on Data.”

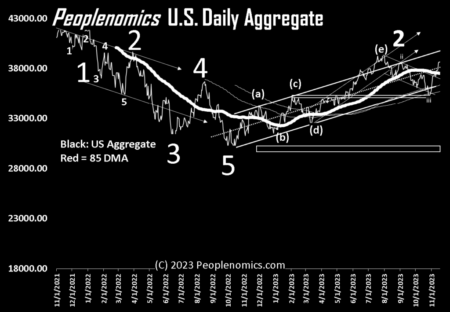

Initially, though – and using two metrics, our 85-day moving average and differential moving average crossings (dma-x) work, we really have a split decision. See here how the 85-day moving average looks?

It’s the heavier line. Obviously, it began its rollover after 7/31 this summer and even though we have had a nice run the past few weeks (costing Ure some Cleveland’s in the process) I still have insufficient confidence in the economy to become an outright Bull, even if the 85-day indicator says for now, be long.

Firehouse Rules

Coming from a family of firefighters, it might make a little more sense – as to why I am bearish now – if you understand fire alarm systems. Of course, most people say, “like a smoke detector?” Like the suspended particulates and a light source? Heavens no.

“Well, ionization type, then?” Sorry, comparing ionization from a slightly radioactive source and ambient isn’t it, either.

So, here’s (thanks to desktop AI) how rate-of-rise fire detection works:

“A rate-of-rise fire detection system is a type of heat detector that operates on a rapid rise in element temperature. It can detect a fire condition at a lower temperature than a fixed threshold detector. It uses a differential pressure switch or an air chamber to measure the rate of temperature change. It can activate the fire alarm when the temperature increase exceeds a certain rate. It is self-restoring when the rate of rise element alone has been activated1.

The rate-of-rise fire detection system works by comparing the temperature of the air in the ambient space with the temperature of the air in a sealed chamber. The chamber has a flexible diaphragm that separates the air from the contacts of the detector. The chamber also has a calibrated leak that allows the air to adjust to normal temperature fluctuations. When the temperature of the ambient air rises faster than the air in the chamber, the diaphragm moves and closes the contacts, triggering the alarm. The rate of rise detector can respond to a fire faster than a fixed temperature detector, but it may not detect slowly developing fires. Therefore, some rate of rise detectors also have a fixed temperature element that will activate the alarm when the temperature reaches a certain level2.”

Depending on the kind of fire safety engineering involved (don’t forget to wire your system with plenum grade wire!) rate of rise is really good stuff to know about.

Ure Returns to Point

“How does this apply to the market?”

In my limited experience (remember, only 74-years now), the operation of a rate-of-rise alarm system (in quickly developing fires and arson, especially) is like the reciprocal of what happens in markets when moving averages run out of steam. Their rate of rise declines, while (obviously in a fire setting) the rate of heat-rise accelerates.

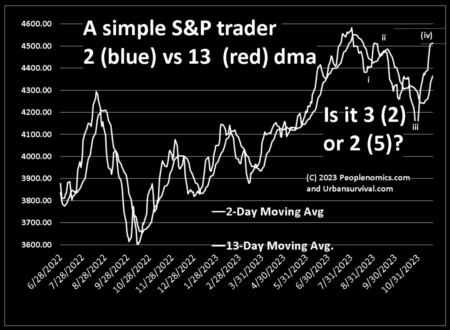

That’s why, when the market began to run out of OOMPH to the upside, we started watching for a narrowing between the 2-day moving average and the 13-day.

Right up by the (iv) on the right, we can (based on the early futures) see a continuation of the “rate of rise failure.” Which may not lead to the “end of World” but it might be enough to return a few “Grant’s” to the trading account.

And it might be an interesting position to hold, since IF this is a Wave (2) of a larger 3 down (since we haven’t gone higher than July 31st) it makes for an interesting speculation. As always, this is never financial advice. Besides, we’ve made it super-clear that markets anymore are all about gambling and anyone who says otherwise is a damned liar.

Final point, because of the almost total backwardation of Humanity since 1980, or so, is the idea that there is NO “Peace Dividend” out there.

See, in a world with zero pop growth, there is only technology and that’s a sure-fire resource stripper. As a result, we have moved into a period where there are only “War Dividends” which is totally the wrong way to run a planet.

Not that it matters. We may begin with inflation on the front-end of The End, but at THE END not only will personal savings be gone, but so will most personal assets, except for the rumored 40 percent of Americans who own their homes free-and-clear. The government will have to return to a solid asset and as our sources tell us, this is why China is moving phys gold back to Beijing as fast as it can pass inspection.

Another one of our “rate of rise” indicators: Bit0-con was almost up to $38,000 last Wednesday. Today, looks to test $37,000 later on at the current rate of drop. Charlie Munger (and I) will be right in the end. Only a CBDC will be allowed over time. We hold to the axiom “Government Hates Competition” and above that? Everything is a Business Model.

Still, shills are ramping up despite the Fed admonitions that they have a 2 percent inflation target and everything less food and energy is still going up north of 4 percent. Stock market news today: Stocks steady as focus turns to Fed rate cuts. The idea of ‘trusting banksters’ doesn’t strike us as sound thinking, but we run to cynical in our outlooks.

Not that it will matter. in The End. Go read G.A. Stewart’s note on the Eve of the Eschaton from last week (if you’re slow on the uptake) and check out the 2024 update to his book Nostradamus and the Third Age of Mars.

Maybe you’ll see why we keep edging out of our interest in paper and over into food production?

BMIP

Business Models In Play.

Politically, CBS is labeling again: Right-wing populist Javier Milei wins Argentina’s presidency amid discontent over economy. Right-wing because he admires Trump, populist because he won? No telling with media and what they’re getting at – if anything. CNBC was a little more clear about it in Milei wins in Argentina, edging the country closer to the U.S. dollar (cnbc.com). Which means if you’re thinking of “going ex-pat” in retirement, will Argentina come up the lists?

Day in Court Summary: Two stories: Federal appeals court to hear Donald Trump, DOJ prosecutors argue over gag order in election conspiracy case. Free Speech vs. Political agendas? The other court story: US Supreme Court hears oral arguments over ban on firearms for people subject to domestic-violence restraining orders – JURIST . Been thinking about this, but seems to us like people are getting due process in DV hearings, so not too sure what the problem is. Except, there’s anti-men bias in some (very lefterly) states. But that’s another case for another venue downstream.

Moving On: Sam Altman’s Transition to Microsoft and The Silent Politics of AI Governance (financemagnates.com). In interestingly, OpenAI new CEO is opening an investigation into why Altman was fired. (Did he say something about Trump? lol. Kidding! Still, didn’t strike us as “right” from the get-go. Should be amusing to find out. Vendettas or more? Stay tuned.

Passing On: Genuinely sorry to learn of the Peanut Farmer’s Companion passing on this weekend. With Rosalynn’s passing, Jimmy Carter faces life alone – The Washington Post. We have always held that Jimmy Carter was not as bad a president as the media made out. In fact, I’d say Carter was almost a prototype for “media assassination of a leader”. Guy was a nuclear sub commander and no dummy. Just a little too “anti-swamp” we’ve always thought. Notwithstanding, Carter’s hard work and dedication to Habitat for Humanity puts him (again, in our view) head and shoulders above presidents (Like, Oh…O, for example). Some go for the “paper” while others do the work and heavy lifting. That way in much of Life, of course.

Still Broken: Apple has still not fixed a security flaw with the new iOS beta | iMore. Not that we are fans, but useful to know.

Around the Ranch: Black Friday Engineering

The Black Friday sales are on and dueling hard now. So far today, we have added another desktop hydroponic unit to the greenhouse.

At $44 bucks and change, the Ceouheia Hydroponics Growing System,12 Pods Indoor Garden System with 36W LED Grow Light, Indoor Herb Garden Plants Germination Kit with Automatic Timer, Adjustable Height looked interesting.

Although we just in the last week added a larger Hydroponics Growing System Herb Garden – MUFGA 18 Pods Indoor Gardening System with LED Grow Light, Plants Germination Kit (No Seeds) with Pump System. It was on a lightning deal this morning for $55 and change.

I know – heavy on the hydroponics, right? Also picked up a trifecta of Tds Meter Digital Water Tester – 4 in 1 Quick & Accurate TDS Temperature (°C, °F) & EC Meter – 0-9990ppm for $10 bucks a pop. TDS = total dissolved solids, how fertilizer availability is measured.

A LOT of reasons for sharing all this with you.

First, while these are small hydroponic systems (compared to the sixteen 5-gallon buckets which are on the way) they are part of “Balancing our Ark” here in the outback to bring up food production potential.

The second point is to remind you that Black Friday sales at the Zon and Wally World are great times to get some basic prepping supplies laid in, if you haven’t. Including accessories like seeds, TDS and PH meters.

If you haven’t done hydroponics in the past, our plan (having done some and even written a book on topic some years back) is to get “back in the groove.” Dirt gardening in East Texas is a gamble in the spring, But much less-so if you figure out how to get hydroponic starts going, so that when hardened out and replanted in dirt (or the big DWC containers) they will be big enough to run ahead of weeds.

There’s a whole multi-part series coming on the Peoplenomics.com site after Thanksgiving, which will go over this whole “Modern Ark building” concept and into a new class of hydroponics and green housing. Because food is better eating than paper.

Back to point, though, about Black Friday.

Focus on Your Plan, Your Ark.

Then get the “most for your plan” for the money.

My cost on the 18-pop unit was $70. Which makes my cost per pod (plant growing site) $3.89 per plant. Two “crops” for transplanting to the dirt garden and you’re at breakeven compared to buying plants at the Big Box Stores in the spring. On the Lightning Deal the cost per plant site drops to around $3.11 per plant site.

While the units may not be as robust as a big AeroGarden Bounty – 9 pods for $159 on sale ($17.66 per plant site), it all really depends on what your use case is. For us, we will be at 42 plant sites. Which gives us a huge capacity for replants. On the other hand, even though 9 pods, the Bounty has more water, and higher lighting, so it makes sense if you are in a condo, for example.

And that’s just a warm-up – things to be thinking about. Start looking for information on personal food production while you can and have lots of options.

You can do wholly “in house” systems (AeroGarden larger sizes rock the field, but are spendy and a half. Or, you can in our case, start hydroponic and then move to dirt in the green house (temp controlled). Or, after “hardening out” (moving the units under cover, but outdoors in the spring while keeping the water around outdoor ground temps) then you can move to soil.

Or, again with the water in the prime grow zone temps, you can go from a small, inexpensive 12 or 18 pod “starting system” and then transplant the grow sponges into hydroton balls in a big 5-gallon DWC operation. (Like 16 buckets and some specialized lettuce racks from PVC pipe for our Ark.)

Way more Topic than there is time in a Monday Morning column. Just telling you, the upcoming Peoplenomics series will become (eventually) a website, book, and some useful 3D .STL files to print for your own healthy food grow op.

We call this whole process (and the book), Balancing the Ark. Because that’s where we each live and if you haven’t generalized how important Arks are (and being aboard one), you either haven’t read a bible or you haven’t done offshore sailing.

We’re blessed to have done both and we do generalize pretty well from 74 and 80 years of experience. 150-years of combined awareness is something a bit different than the two-day headline flashing hate-media bullshit. For which we are ever grateful.

Write when you get rich and self-sufficient in some measure,

George@Ure.net