Too hot to keep the odds of another Fed hike at zero?

NEW YORK, OCTOBER 31, 2023: S&P Dow Jones Indices (S&P DJI) today released the latest

results for the S&P CoreLogic Case-Shiller Indices, the leading measure of U.S. home prices. Data

released today for August 2023 show that 13 of the 20 major metro markets reported month-overmonth price increases.

YEAR-OVER-YEAR

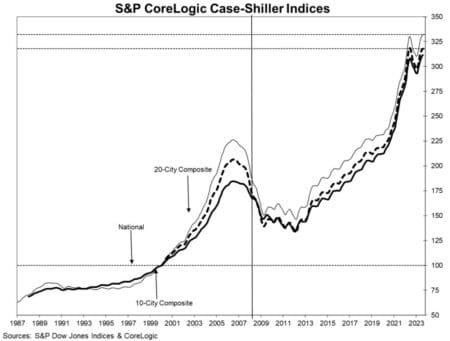

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census

divisions, reported a 2.6% annual change in August, up from a 1.0% change in the previous month. The

10-City Composite showed an increase of 3.0%, up from a 1.0% increase in the previous month. The

20-City Composite posted a year-over-year increase of 2.2%, a slight increase of 0.2% in the previous

month.

Chicago led the way for the fourth consecutive month, reporting the highest year-over-year gain among

the 20 cities in August. For this month, seven of 20 cities reported lower prices. Twelve of the 20 cities

reported higher prices in the year ending August 2023 versus the year ending July 2023. Nineteen of

the 20 cities show a positive trend in year-over-year price acceleration compared to the prior month.

MONTH-OVER-MONTH

Before seasonal adjustment, the U.S. National Index,10-City and 20-City Composites, all posted a

0.4% month-over-month increase in August.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.9%, while

the 10-City and 20-City Composites posted a 1.0% increase each.

ANALYSIS

“U.S. home prices continued to rise in August 2023,” says Craig J. Lazzara, Managing Director at S&P

DJI. “Our National Composite rose by 0.4% in August, which marks the seventh consecutive monthly

gain since prices bottomed in January 2023. The Composite now stands 2.6% above its year-ago level

and 6.4% above its January level. Our 10- and 20-City Composites each also rose in August, and

likewise currently exceed their year-ago and January levels.

To us, this looks hot enough to at least have someone figure this could kick the Fed over into a quarter percent hike tomorrow.

Looks to us like Housing is maybe too hot for the Fed to sit out a hike.

Write when you get rich,

George@Ure.net